Archive

-

REITs Overview

- Definition of REITs

- REITs Operating Flow

-

REITs – Investor & Sponsor Benefits

- From an Investor’s Perspective

- From a Corporate/Sponsor Perspective

-

• Tool to secure corporate headquarters ownership

• Vehicle for asset monetization

• Mechanism to de-risk and stabilize development projects

-

Types of REITs and Key Characteristics

- REIT Categories

- Category-Specific Attributes

-

REITs Market Trends

- Sustained Growth

- AUM Trajectory

REITs Overview

- Definition of REITs

-

"Koramco Asset Management’s Research & Strategy (R&S) team released its ‘1Q 2025 Commercial Real Estate Market Report (Recovery Amid Uncertainty: Uneven but Rebounding).’ The report covers offices, logistics, data centers, and hotels. While deal volumes are rising, Koramco notes that macro and geopolitical uncertainty remains elevated. With liquidity still tight, investors are screening opportunities more selectively than in prior cycles.

By sector, Seoul office vacancy rose to ~4.9%, up roughly 2ppt YoY, driven by new supply in the Magok district. Given relatively lower rents vs. other submarkets, Magok should appeal to cost-conscious occupiers. Roughly 3.27 million m² of new CBD stock (≈35% of existing CBD inventory) had been slated post-2029; however, start delays imply completions will be pushed out by several years.

New logistics supply has clearly rolled over, easing oversupply concerns. Prime logistics cap rates now exceed ~6%. Investment demand is expected to concentrate in facilities with tenant-preferred specifications.”"

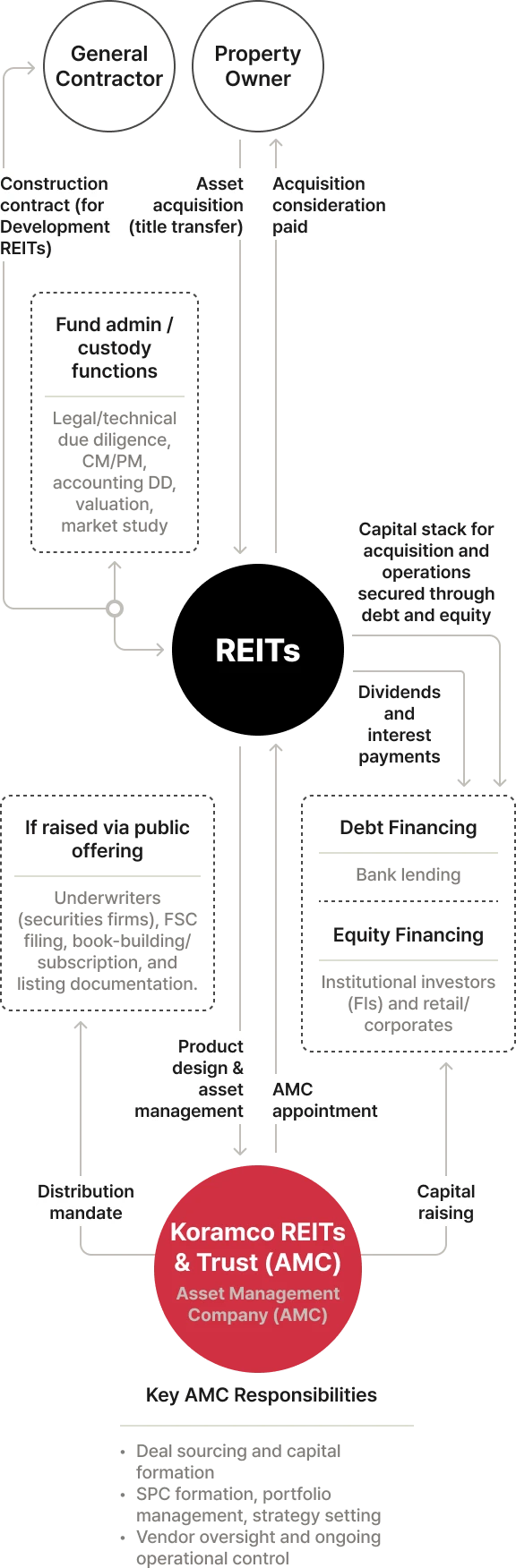

- REITs Operating Flow

-

Benefits of REITs

- For Investors

-

- Attractive Risk-Adjusted Returns

- Disciplined research-driven acquisitions can deliver compelling risk-adjusted returns; value-add initiatives (e.g., capex/remodeling) and institutional asset management unlock incremental NOI and capital gains.

- Resilience and Inflation Hedge

- Backed by real assets, REITs provide a partial inflation hedge. Downside is mitigated by liquidation value, while prudent underwriting on rents, vacancy and opex supports stable dividend yields.

- Liquidity

- Listed REIT shares can be traded and monetized in cash markets.

- Access to Institutional-Grade Assets

- Enables smaller tickets to participate in large-scale, institutional real estate.

- For Corporates / Occupiers

-

Headquarters Acquisition Solution

Achieve owner-like control and optimize balance-sheet/lease economics, leveraging AMC best-practice operations to maximize efficiency.- Building naming rights available

- External signage (naming rights) permitted

- Board representation enables participation in key operating decisions

- Future leasing needs can be pre-coordinated for proactive responses

- Meet HQ ownership needs with modest equity (≈10% of total capitalization)

- Participate in rental income and asset appreciation as a shareholder

- Capture below-market effective rents to lower occupancy cost

- Right of first offer/first refusal can secure long-term ownership optionality

- Professional AMC governance minimizes operational risk

- Structure allows corporates to focus on core business and enhance competitiveness

- Tax Efficiency

- Distributing ≥90% of distributable income generally eliminates entity-level corporate tax (Korean CTA §51-2). Compared with direct ownership, REIT holdings benefit from favorable local tax treatment on land components (e.g., flat 0.2% property tax rate and exclusion from comprehensive real estate tax under Local Tax Act §106 & Enforcement Decree §102).

Asset Monetization

De-recognize fixed assets to improve leverage and liquidity; maintain strategic influence via REIT equity and ROFO/ROFR to facilitate repurchase at vehicle maturity.- Use sale proceeds to delever the balance sheet

- Hold REIT equity to retain owner-like status and receive income

- ROFO/ROFR enables re-acquisition at REIT exit

- Affiliate facility-management capabilities can be utilized

Stabilizing Development Risk

A development REIT can act as the nominal developer/borrower (SPC), with conditional forward-purchase structures allowing contractors/developers to sell all or part under completion terms, funding project costs via the REIT’s pre-acquisition.- Direct Development via REIT

-

- Development REIT serves as SPC/borrower of record

- AMC leads business planning and financing; AMC executive may serve as REIT representative director

- Forward-Purchase (Completion) Structure

-

- Developer/contractor sells whole or part to the REIT subject to completion

- Pre-acquisition proceeds fund project costs → lower carry and greater execution certainty

- Joint Development via In-Kind Land Contribution

-

- Landowners/corporates contribute land in kind to the REIT, which then undertakes development

Types and Characteristics of REITs

- REIT Categories

-

Type Legal Form Investment Focus Description Corporate Restructuring (CR) REITs Paper company (statutory vehicle) Distressed/turnaround real estate Invest/operate via a professional AMC (e.g., Koramco REITs & Trust) Externally Managed REITs Paper company (statutory vehicle) General real estate Self-Managed REITs Operating company General real estate Invest/operate internally with in-house staff

• No pass-through tax benefits at the corporate level

- 종류별 특성

-

Item Externally Managed CR REITs Self-Managed Investment Focus General real estate Corporate restructuring assets General real estate Entity Form Paper company (no full-time staff) Paper company (no full-time staff) Operating company (in-house staff) Minimum Capital KRW 5bn KRW 5bn KRW 7bn Shareholding Dispersion No single holder >50% No limit Shareholding Dispersion Public Offering ≥30% of capital Not mandatory (private placement allowed) ≥30% of capital Listing Eligible upon meeting criteria Not mandatory Eligible upon meeting criteria Asset Composition • ≥80% real estate & related securities

• ≥70% direct real estate≥70% direct real estate • ≥80% real estate & related securities

• ≥70% direct real estateDevelopment Allocation Up to 100% with shareholder approval

REITs Market Trends

- Sustained Growth

-

"As of end-Dec 2024, Korea had 400 operating REITs with aggregate AUM of KRW 100.07 trillion—the first time the market surpassed KRW 100 trillion since inception. Growth has been underpinned by allocator diversification, rising demand for alternatives, and corporates’ monetization needs.

Policy support for public REITs—tax incentives and listing facilitation—has broadened the investor base and accelerated new listings.

Koramco is the only AMC managing three listed REITs (E-REITS KOCREF, Koramco Energy REIT, Koramco The One REIT), driving share gains through capability building and product differentiation while broadening retail access and elevating market quality."

- AUM Trajectory

-

"As of December 2024, 400 REITs were active in Korea, with total AUM reaching KRW 100.07 trillion—the largest scale since the system’s introduction. Growth has been driven by investors’ demand for diversification, rising appetite for alternative assets, and corporates’ increasing use of REITs for capital recycling.

Government initiatives promoting public and listed REITs, including tax incentives, have strengthened market infrastructure and expanded investor participation.

KORAMCO is the only REIT AMC in Korea managing three listed REITs—E-REITs KOCREF, KORAMCO Energy REIT, and KORAMCO The One REIT. Leveraging its differentiated product expertise, KORAMCO continues to strengthen its market leadership while advancing the qualitative growth of Korea’s REIT market and expanding access to indirect real estate investments."