Archive

-

Real Estate Funds

- Fund Overview

- Fund Operating Flow

- Fund Types

-

Multi-Asset / Blind Funds

- Multi-Asset Funds

- Blind Funds

- Investment Universe

Real Estate Funds

- Fund Overview

-

Definition of Real Estate Fund (Collective Investment Scheme)

Invests more than 50% of fund assets in “real estate, real estate rights, or real estate-related assets,” distributing resultant income to investors.- Investment Targets

-

Real Estate

- Acquisition and disposition

- Development

- Operations and capex enhancement

- Leasing

Real estate rights

- Surface/servitude/jeonse/lease/assignment rights, etc.

- Real-estate-secured receivables held by financial institutions

- Monetary claims

Real-estate-related assets

- Securities (fund units/ABS) with ≥50% exposure to the above

- REIT equities

- PFV shares

- SPC equity interests

- Real-estate-linked derivatives

- Loans to development entities, etc.

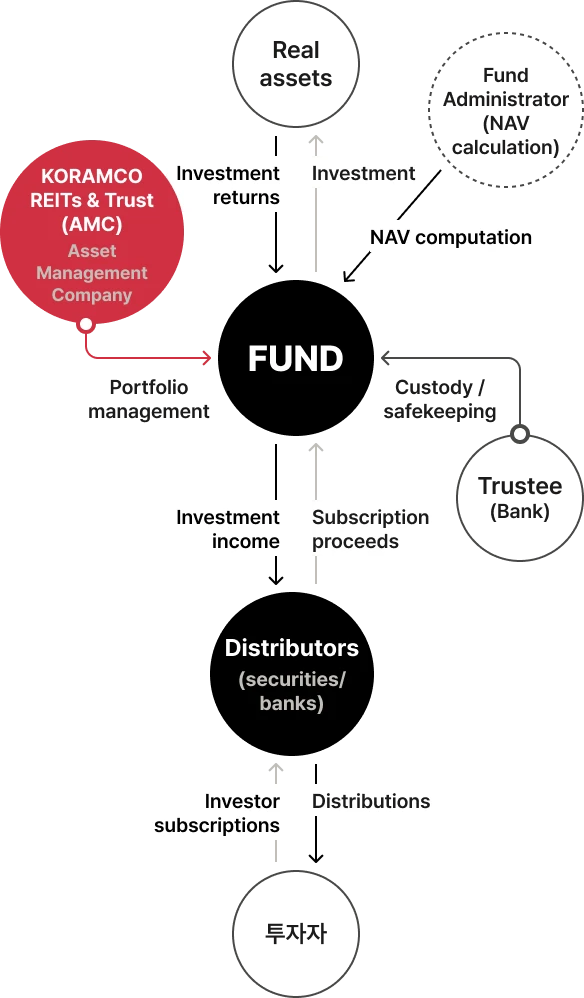

- Fund Operating Flow

-

- Fund Types

-

- Buy-and-Lease Income Funds

- A Buy & Lease Real Estate Fund primarily acquires and leases office or commercial properties to generate stable rental income while pursuing capital gains through long-term appreciation in asset value.

- Auction/Distressed Value Funds

- A Value Real Estate Fund acquires office or commercial properties at discounted prices through court auctions or public sales conducted by asset management institutions or financial institutions, and seeks returns through leasing or resale at enhanced market value.

- Derivative-Linked Funds

- A Derivative Real Estate Fund primarily invests in derivative instruments backed by real estate as the underlying asset.

- Debt / Project Financing Funds

- A Project Financing Real Estate Fund primarily provides loans to development entities (developers) and generates returns through interest income from these loans, focusing on debt-based investment structures in real estate development projects.

- Development Funds

- A Development Real Estate Fund directly undertakes real estate development projects by assuming the role of a developer, generating returns through sales or leasing profits from completed assets.

- Rights-Based Funds

- A Beneficial Interest Real Estate Fund invests in trust beneficiary rights, real estate-backed debt instruments, and securities issued by real estate collective investment schemes.

- Securities-Focused Funds

- A Securities Real Estate Fund invests in REIT shares, securities issued by Project Financing Vehicles (PFVs), and equity interests of Special Purpose Companies (SPCs) engaged in real estate investment.

Multi-Asset / Blind Funds

- Multi-Asset Funds

-

- What is a Multi-Asset Fund?

-

"Multi-asset funds operate without rigid constraints on target or weights, leveraging Koramco’s alternatives expertise and incorporating structured strategies.

Stable income from real-estate assets (funds, domestic/global REITs) is complemented by diversified allocations to structured strategies (mezzanine/PEF/structured notes), targeting superior risk-return vs. traditional balanced products."

- Blind Funds

-

- What is a Blind Fund?

-

"Unlike traditional funds that raise capital for predetermined assets, a Blind Fund is established without specifying investment targets in advance and deploys capital selectively once high-quality opportunities are identified.

By not predetermining investment targets, Blind Funds offer greater flexibility to respond proactively to evolving market conditions."

- Investment Scope

-

Selective allocations across alternatives (real estate/infrastructure), absolute-return strategies, and traditional assets (equities/bonds).

- Alternatives

- Real estate, infrastructure, development projects

- Traditional Assets

- Pair trades, IPOs, block deals, listed REITs (domestic/global)

- Strategic Assets

- PEF, VC, mezzanine (CB/BW), structured products